The Ultimate Guide to Inter-App Money Transfers

In the digital age, managing finances seamlessly across multiple platforms is essential. Whether you need to send money to a friend or make a payment online, the convenience of inter-app money transfers is a game-changer. This article will provide a comprehensive guide on how to transfer money from Venmo to Cash App, ensuring a hassle-free and efficient experience.

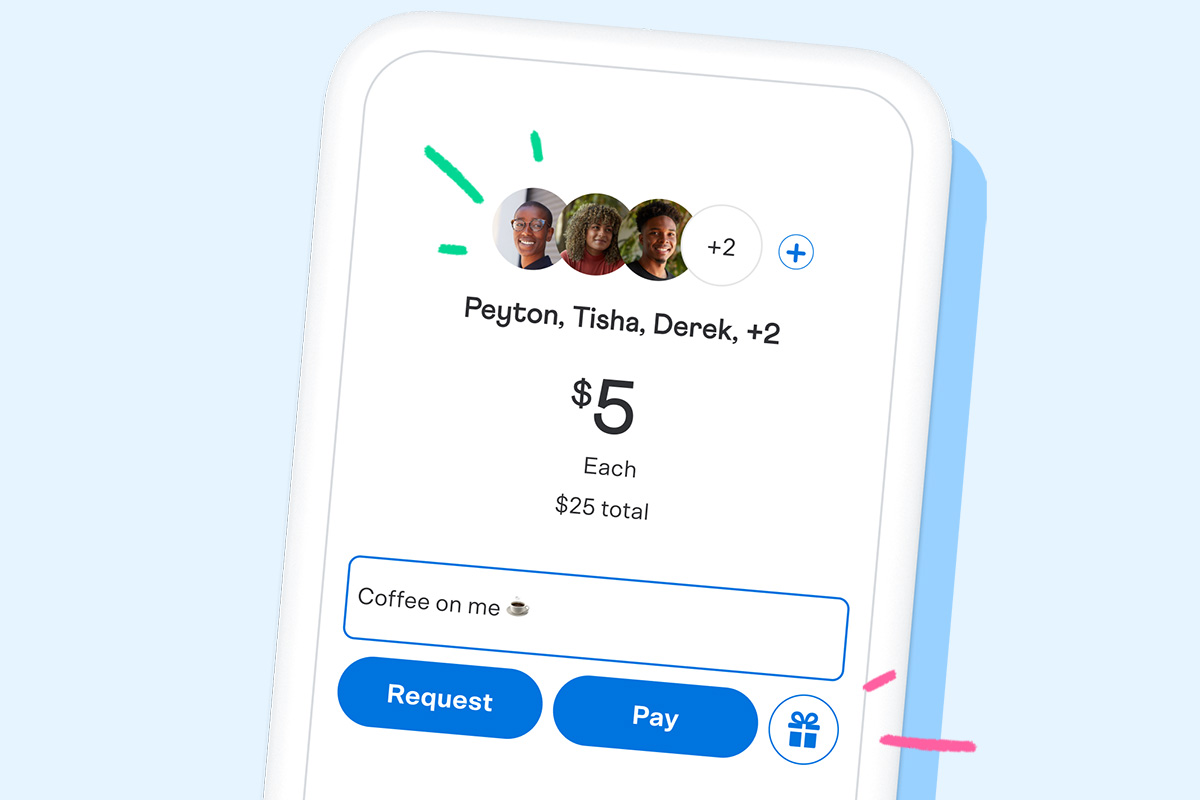

Image: www.nonprofitpro.com

Understanding Venmo and Cash App

Venmo and Cash App are two of the most popular mobile payment platforms used for sending and receiving money. Both apps connect to your bank account and allow you to make payments online, in-store, or to individuals.

Venmo is known for its social media-like interface, where users can add friends and interact with them through comments and emojis. Cash App, on the other hand, has a simpler interface focused on faster payments and added functionalities like stock trading and crypto purchases.

Steps to Transfer Money from Venmo to Cash App

- Open the Venmo app and log in.

- Tap on the “Pay or Request” button.

- Enter the Cash App username or phone number of the recipient.

- Input the amount you want to transfer.

- Add a note (optional).

- Tap on “Pay” and confirm the transaction.

Once you complete these steps, the funds will be transferred from your Venmo account to the recipient’s Cash App account instantly.

Fees and Limits

Venmo and Cash App have different fee structures and transaction limits:

- Venmo: Charges a 3% fee (minimum $0.25) for instant transfers to non-Venmo users. Standard transfers are free.

- Cash App: No fees for standard transfers. Instant transfers may incur a fee of up to 3%.

both apps have daily and monthly transfer limits, which can vary depending on your account status.

Image: fabalabse.com

Expert Tips for Smoother Transfers

To maximize your experience, consider these expert tips:

- Use a bank-linked account: Link your Venmo and Cash App accounts to your bank account for faster and more secure transactions.

- Verify your identity: Completing the identity verification process on both platforms can increase transaction limits and reduce potential account issues.

- Be cautious of scams: Always verify the recipient’s information before sending money. Never share your banking information or password with anyone.

FAQs

Q: How long does it take to transfer money?

A: Standard transfers are usually processed within 1-3 business days, while instant transfers are completed immediately.

Q: What if the recipient does not have a Cash App account?

A: If the recipient does not have a Cash App account, you can send them a payment link via text or email. They can then create a Cash App account and claim the funds.

Q: Are there any limits to how much I can transfer?

A: Transfer limits vary based on your account status and the platform you are using. Check the Help Center of both Venmo and Cash App for the most up-to-date information.

How To Send Money From Venmo To Cash App

Conclusion

Transferring money from Venmo to Cash App is a convenient and straightforward process. By following the steps outlined in this guide, you can seamlessly send funds between these platforms. Keep in mind the fee structures, transfer limits, and expert tips discussed in this article to enhance your money transfer experience. With Venmo and Cash App, you have a reliable and efficient solution to manage your finances across different apps.

Are you an avid user of Venmo and Cash App? Share your tips and tricks for inter-app money transfers in the comments below.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)

:max_bytes(150000):strip_icc()/142202371-5ab3dbf1ff1b78003633a0dd.jpeg?w=740&resize=740,414&ssl=1)