Introduction:

In today’s fast-paced digital world, seamless and effortless money transfers are more essential than ever. Venmo and Cash App have emerged as popular mobile payment solutions, simplifying P2P (peer-to-peer) transactions. However, the challenge often lies in transferring funds between these platforms. This comprehensive guide will provide a step-by-step explanation of how to transfer money from Venmo to Cash App, empowering you to navigate the process with ease. We’ll also explore potential fees, timeframes, and any additional details to ensure a smooth and successful transfer.

Image: lindeleafeanor.blogspot.com

Step 1: Verify Account Details

Before initiating the transfer, ensure you have access to both your Venmo and Cash App accounts. Verify the account balance on Venmo and confirm that it’s sufficient to cover the intended transfer amount. Keep your Cash App account details readily available as you’ll need it shortly.

Step 2: Add Cash App Recipient

Open the Venmo app and navigate to the “Pay Someone” section. Enter your Cash App recipient’s registered mobile number or email address in the “Find Venmo or Enter Phone/Email” field. Ensure the recipient is using Cash App to receive the funds.

Step 3: Enter Transfer Amount

Once you’ve found the recipient, input the desired transfer amount in the “Amount” field. Venmo allows transfers of up to $4,999.99 per transaction.

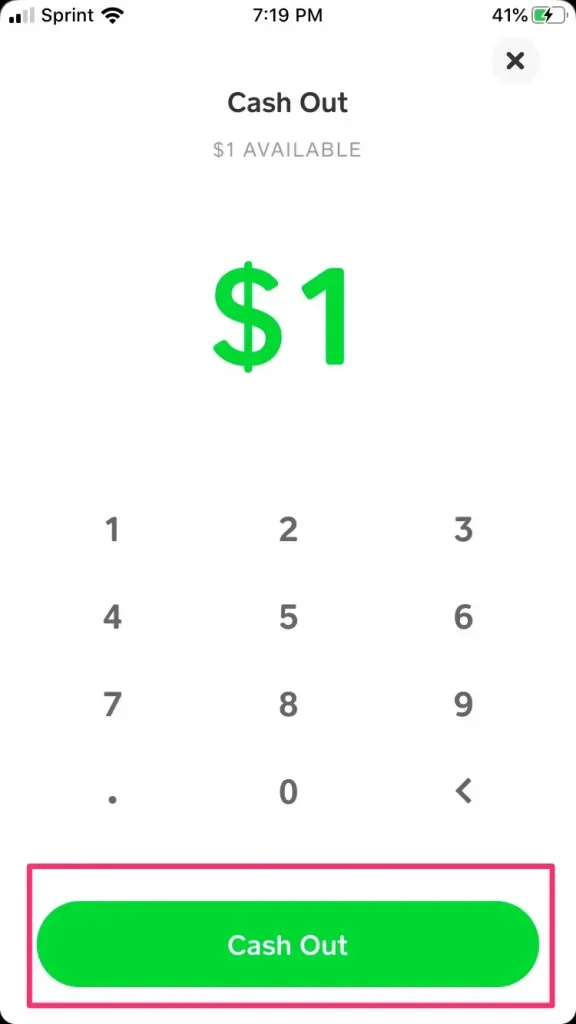

Image: wealthynickel.com

Step 4: Choose Your Funding Source

Venmo offers flexibility in funding your transfer. You can opt to use your Venmo balance, linked bank account, or debit card. Select your preferred funding method by clicking on the “Pay With” option.

Step 5: Confirm Transaction

Review the transaction details carefully, including the amount, recipient’s information, and funding source. If everything appears correct, tap the “Pay” button to proceed. Venmo will send a notification to your recipient indicating the incoming funds.

Timeframe and Fees:

Venmo’s standard money transfers are processed instantly and typically reflected in the recipient’s Cash App balance within minutes. However, it’s worth noting that Venmo charges a 3% fee for using a credit or debit card as the funding source. If you use your Venmo balance or linked bank account, there’s no transaction fee.

Additional Considerations:

- Keep in mind that you can’t transfer money from Venmo to Cash App using a corporate or business account.

- If the recipient’s Cash App account is not verified, the funds may take longer to appear.

- You can cancel a money transfer on Venmo before it’s completed. However, once the transaction is processed, it’s irreversible.

- For security reasons, Venmo limits the frequency and amount of transactions allowed within a certain time frame.

- If you encounter any issues during the transfer process, don’t hesitate to contact Venmo or Cash App customer support for assistance.

How To Transfer Money From Venmo To Cash App

Conclusion:

Transferring money from Venmo to Cash App is a convenient and hassle-free process that bridges the gap between different mobile payment platforms. By following these simple steps and understanding the potential fees and timeframes, you can swiftly and securely transfer funds between your accounts. Whether you need to repay a friend, split a bill, or simply move funds between your accounts, this guide provides a comprehensive roadmap to ensure a seamless and successful transaction.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)