Introduction

Managing your finances effectively involves understanding the ins and outs of check writing, including the proper way to fill out the back of a check. Whether you’re making a personal payment or handling business transactions, this seemingly simple task can become daunting if you’re unsure about the specific steps involved. This article delves into the intricacies of filling out the back of a check, providing clear instructions and helpful tips to ensure you’re doing it right.

Image: www.animalia-life.club

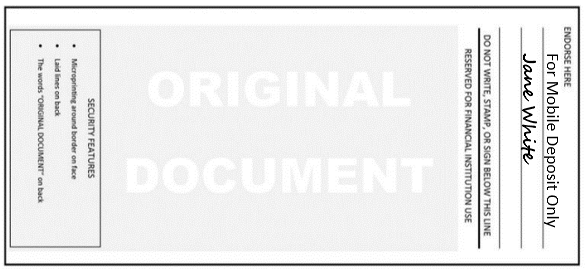

Endorsements: Your Signature and Beyond

The back of a check primarily serves as a space for endorsements. An endorsement is a legally binding signature that authorizes the recipient to cash or deposit the check. When endorsing a check, there are two main options:

- Blank Endorsement: Simply signing your name on the back of the check without any additional information. This grants the bearer of the check full rights to cash or deposit it.

- Restrictive Endorsement: Includes additional instructions, such as “Deposit Only” or “Pay to the Order of [another person’s name]”. This limits who can cash or deposit the check and adds an extra layer of security.

Beneficiaries: Understanding “Payee”

The “Payee” line at the top of a check indicates the person or business to whom the check is addressed. If you’re filling out the back of the check as the payee, you must sign within this designated space to confirm your acceptance of the payment and your understanding of any conditions attached to it.

Special Instructions: Communicating Beyond the Signature

In certain situations, you may need to add additional instructions on the back of the check. For instance, if you want the check to be deposited into a specific account or used for a particular purpose, you can include a note below your endorsement. However, these instructions must be brief and clear, as space is limited.

:max_bytes(150000):strip_icc()/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg)

Image: eliciabrennan.blogspot.com

Common Pitfalls to Avoid

- Incomplete Endorsement: Forgetting to sign your name or omitting necessary details in a restrictive endorsement can cause delays or even rejection of the check.

- Unauthorized Endorsement: Never endorse a check for someone else without their explicit authorization. This can be a serious legal issue.

- Over-Endorsement: If you receive a check that has multiple signatures or endorsements, be cautious. This can indicate that the check has been stolen or tampered with.

- Invalid Spaces: Partially writing on or crossing out signatures can make the endorsement difficult to interpret and potentially void. Avoid writing over or altering any information on the back of the check.

Additional Tips for Peace of Mind

- Use a Pen: When endorsing a check, always use a pen to ensure the ink is permanent and legible.

- Write Clearly: Take your time and sign in clear, legible writing to prevent confusion or misreadings.

- Secure Storage: Keep endorsed checks in a safe place until they’ve been cashed or deposited.

- Verify Recipients: If you’re endorsing a check over to someone else, verify their identity and obtain a signed receipt to document the transaction.

How To Fill Out Back Of Check

Conclusion

Filling out the back of a check is a crucial step in the check-writing process. By following the instructions outlined in this article, you can endorse checks securely and efficiently, whether for personal or business purposes. Remember to use clear writing, understand the different endorsement types, and avoid common pitfalls to ensure your checks are handled correctly.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)