Prologue

In today’s digital age, seamless money transfers have become an indispensable aspect of our lives. Venmo and Cash App, two widely popular mobile payment platforms, have revolutionized the way we send and receive funds. However, many users have encountered a puzzling hurdle: the inability to transfer money directly from Venmo to Cash App. This article aims to shed light on the reasons behind this restriction and provide alternative solutions to facilitate money transfers between these two services.

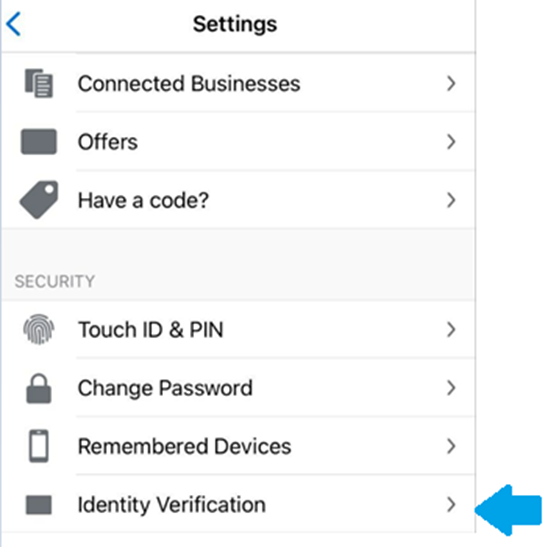

Image: help.venmo.com

Understanding the Obstacle

The inability to transfer money from Venmo to Cash App stems from fundamental differences between the two platforms’ underlying infrastructure and operational policies. Venmo is intricately linked to the PayPal network, while Cash App operates on its own independent system. This separation creates a technical barrier that prevents direct fund transfers between the two services.

Furthermore, Venmo adheres to strict regulations set forth by financial institutions and government agencies. These regulations prioritize security and fraud prevention, which can sometimes result in limitations on certain types of transactions, including cross-platform transfers.

Exploring Alternative Solutions

While direct transfers from Venmo to Cash App are not feasible, there are several alternative methods to facilitate money transfers between these platforms. Each option has its unique advantages and drawbacks:

-

Linking Bank Accounts:

This method involves connecting both your Venmo and Cash App accounts to a common bank account. Once linked, you can transfer funds from Venmo to the bank account and then withdraw them into Cash App. While this method is relatively straightforward, it may incur additional fees for bank transfers.

-

Image: makeanapplike.comUsing Third-Party Services:

Several third-party services, such as Zelle or PayPal’s Xoom, allow you to transfer funds between different payment platforms. These services may charge a small fee for their services, but they offer convenience and a wider range of transfer options.

-

Exchanging Gift Cards:

An unconventional yet effective method is to purchase a gift card from one platform and redeem it on the other. For instance, you could buy a Venmo gift card and redeem it in Cash App, effectively transferring funds indirectly.

Navigating the Restrictions

Understanding the reasons behind the inability to transfer money from Venmo to Cash App directly can help you navigate the limitations and find alternative solutions that suit your needs. Here are some additional tips to optimize your experience:

-

Familiarize yourself with the terms and conditions of both platforms to avoid any unexpected issues or restrictions.

-

Keep your accounts secure by using strong passwords and enabling two-factor authentication. This safeguards your funds from unauthorized access.

-

Consider the fees associated with each transfer method and choose the option that offers the most cost-effective solution.

Why Can’T I Transfer Money From Venmo To Cash App

Conclusion

While the inability to transfer money from Venmo to Cash App directly can be frustrating, there are several alternative methods available to facilitate seamless fund transfers. By understanding the reasons behind the restrictions and exploring alternative solutions, you can ensure that your money moves smoothly between these popular payment platforms. Remember to prioritize security, navigate the limitations wisely, and embrace the convenience that digital payments offer in today’s rapidly evolving financial landscape.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)