How to Block a Credit Card Payment and Reclaim Your Financial Freedom

Credit cards can be convenient, but sometimes it can feel like they are in control instead of us. If you’re finding yourself struggling to keep up with your credit card payments, it may be time to take action and block a payment. Blocking a payment can provide you with some breathing room and help you regain control over your finances.

Image: designbundles.net

What is a credit card payment block?

A credit card payment block is a temporary or permanent order that you can put on your credit card account to stop a certain payment from going through. This can be helpful if you believe the payment is fraudulent, if you made an error, or if you can’t afford the payment.

How to block a credit card payment

There are two ways to block a credit card payment:

- Contact your credit card issuer. You can call the customer service number on the back of your credit card or log into your online account to request a payment block. You will need to provide the details of the payment you want to block, including the amount, the date, and the payee.

- Dispute the payment. If you believe the payment is fraudulent or you made an error, you can dispute the payment with your credit card issuer. You will need to provide documentation to support your claim, such as a copy of your receipt or a statement from the merchant.

What happens when you block a payment

When you block a payment, it will not be processed by your credit card issuer. This means that the merchant will not receive the payment, and you will not be charged for it. If you have already made the payment, you may be able to get a refund from the merchant.

Risks of blocking a payment

There are a few risks associated with blocking a payment:

- It may damage your credit score. If you block a payment without a valid reason, it could damage your credit score.

- You may incur late fees. If you block a payment and do not pay it by the due date, you may incur late fees.

- You may not be able to get a refund. If you block a payment and the merchant does not issue a refund, you may not be able to get your money back.

Benefits of blocking a payment

There are also some benefits to blocking a payment:

- It can stop a fraudulent payment. If you believe a payment is fraudulent, blocking it can prevent the fraudster from getting your money.

- It can give you time to get back on track. If you are struggling to make your credit card payments, blocking a payment can give you some breathing room to catch up.

- It can help you regain control of your finances. Blocking a payment can help you regain control over your finances and prevent you from falling into debt.

Alternatives to blocking a payment

If you are considering blocking a payment, there are a few alternatives that you may want to consider:

- Negotiate with the merchant. You may be able to negotiate with the merchant to reduce the amount of your payment or to set up a payment plan.

- Contact a credit counseling agency. A credit counseling agency can help you develop a plan to manage your debt and avoid future problems.

- File for bankruptcy. In some cases, filing for bankruptcy may be the best option to get out of debt.

Blocking a credit card payment can be a helpful tool to regain control over your finances. However, it is important to weigh the risks and benefits before you take this action. If you are unsure whether or not blocking a payment is the right decision for you, it is best to talk to a credit counselor or a financial advisor.

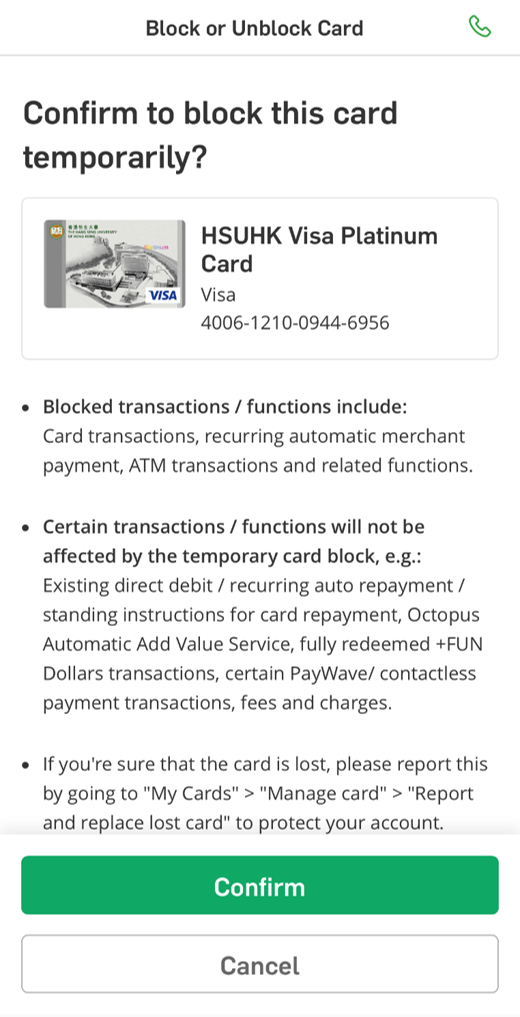

Image: www.hangseng.com

How To Block A Credit Card Payment

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)