In the realm of homeownership, understanding monthly mortgage payments is akin to navigating a financial labyrinth. With Excel at our disposal, we embark on a path to demystify this crucial aspect, paving the way for informed decision-making.

Image: db-excel.com

Delving into the Mortgage Maze

A mortgage, the bedrock of home financing, is a loan secured against the property purchased. Repayment is typically spread over several decades, monthly installments consisting of principal and interest. Excel, with its unparalleled computational prowess, empowers us to unravel this financial puzzle.

Step-by-Step Excel Calculation

-

Gather Essential Details: Assemble the following information: loan amount, interest rate (as a percentage), loan term (in years), and any additional fees or prepaid interest.

-

Launch Excel and Select Function: Type “=PMT(” in an empty cell. This function computes monthly payments based on given inputs.

-

Fill in the Arguments: Within the parentheses, enter the following arguments:

- Rate: Convert the interest rate to a monthly decimal by dividing by 1200 (e.g., 3.5% annual rate becomes 0.002916).

- Nper: Enter the loan term in months (e.g., 30-year loan = 30 * 12 = 360 months).

- Pv: Input the loan amount as a negative value (e.g., -$200,000).

- Fv: Leave this argument blank (0) to indicate no future value at the end of the loan.

-

Finalize the Formula: Press “Enter” to complete the formula. Excel will calculate the monthly payment in the selected cell.

-

Additional Considerations: If there are any additional fees or prepaid interest, adjust the Pv value accordingly. For example, if $5,000 in closing costs were paid upfront, modify Pv to -$205,000.

Beyond Calculation: Excel’s Analytical Power

Excel’s capabilities extend beyond mere calculation. By leveraging its robust features, we can delve into a granular analysis of mortgage payments:

-

Payment Breakdown: By adjusting the “-Fv” portion of the formula, we can isolate principal and interest components of each monthly payment.

-

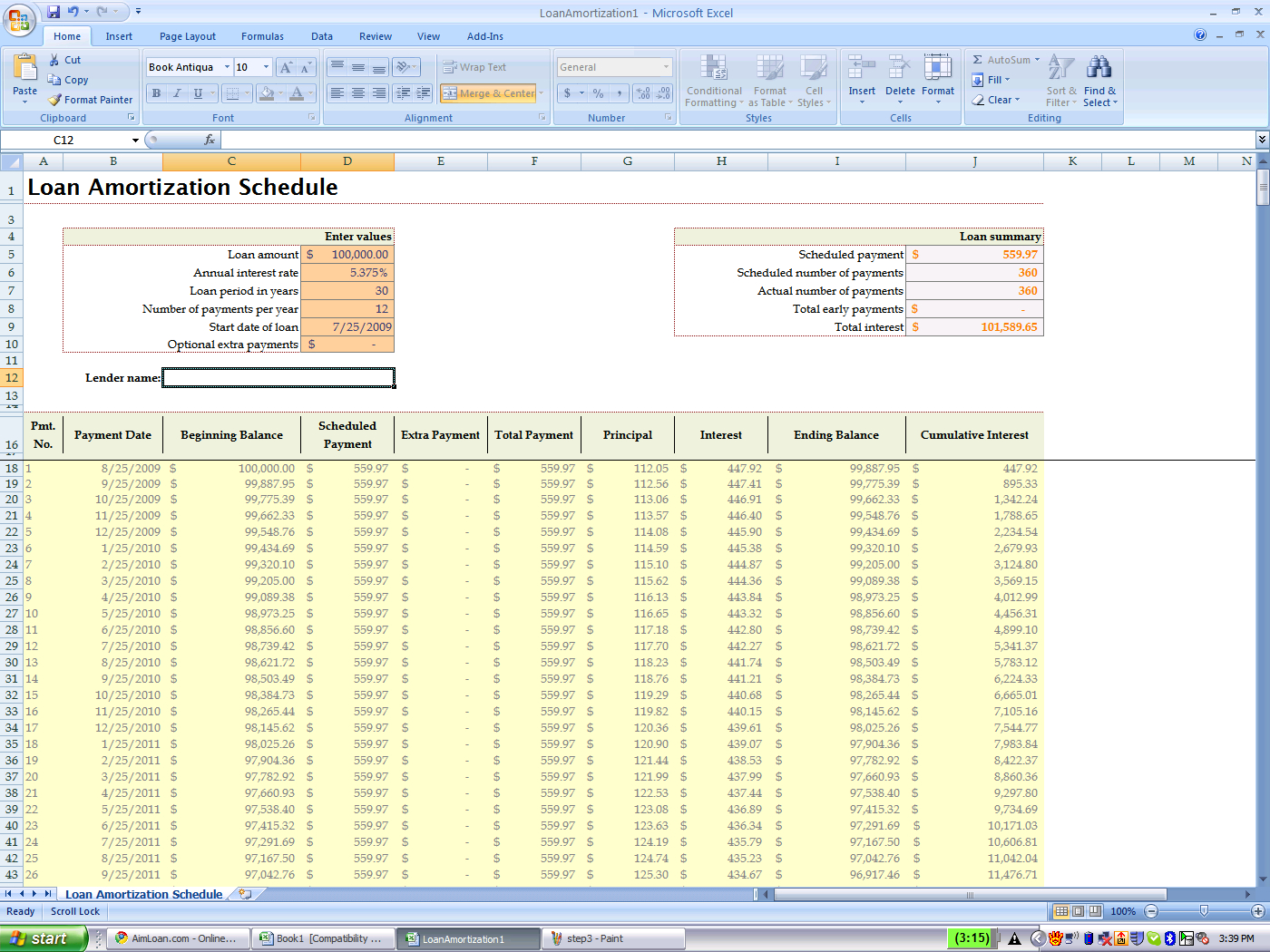

Amortization Schedule: With the “AMORLINT” function, we can generate a detailed table outlining the distribution of principal and interest payments over the loan duration.

-

Scenario Analysis: Excel’s “Data Table” tool enables us to compare different mortgage scenarios by varying interest rates, loan terms, or fees.

Image: exceljet.net

Expert Insights and Practical Guidance

Industry experts emphasize the importance of considering additional factors beyond monthly payments, including:

-

Property Taxes and Insurance: These expenses often factor into mortgage escrow accounts, potentially increasing monthly obligations.

-

Income and Expenses: Ensure that mortgage payments are within budget, considering other necessary expenses and savings goals.

-

Down Payment: A higher down payment can reduce the loan amount and potentially lower monthly payments.

How To Figure Out Monthly Mortgage Payments In Excel

Conclusion: Empowered Homebuyers

Equipped with the power of Excel, we have unveiled the mysteries of monthly mortgage payments. This newfound knowledge equips us to make sound financial decisions, securing affordable and fulfilling homeownership journeys. By harnessing Excel’s analytical prowess, we gain clarity and confidence in navigating the complexities of mortgage financing.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)