Introduction

In the intricate world of finance, understanding the effective interest rate is crucial for making sound investment decisions. It represents the true cost or return on a loan or investment over a specific period, taking into account the impact of compounding. Unlike the nominal rate, which is the quoted interest rate, the effective rate encompasses the compounding effect that can significantly alter the overall value of your money. Embark on this comprehensive journey as we delve into the nuances of calculating and deciphering the effective interest rate, empowering you to make informed financial choices.

The Anatomy of Interest Rates

To fully grasp the concept of effective interest rate, it’s essential to understand the fundamental building blocks of interest rates. Interest is the charge levied for borrowing money or the reward earned for lending it. It is typically expressed as a percentage of the principal amount, the sum of money borrowed or invested. The nominal interest rate, often referred to simply as the interest rate, is the stated rate of interest for a given period, such as monthly or annually.

Enter the Effective Interest Rate

The effective interest rate, often denoted as the annual percentage rate (APR) or annual effective rate (AER), goes beyond the nominal rate. It takes into account the compounding effect, which is the accumulation of interest on previously accrued interest. Compounding can either amplify your earnings or increase your borrowing costs depending on whether you’re an investor or a borrower.

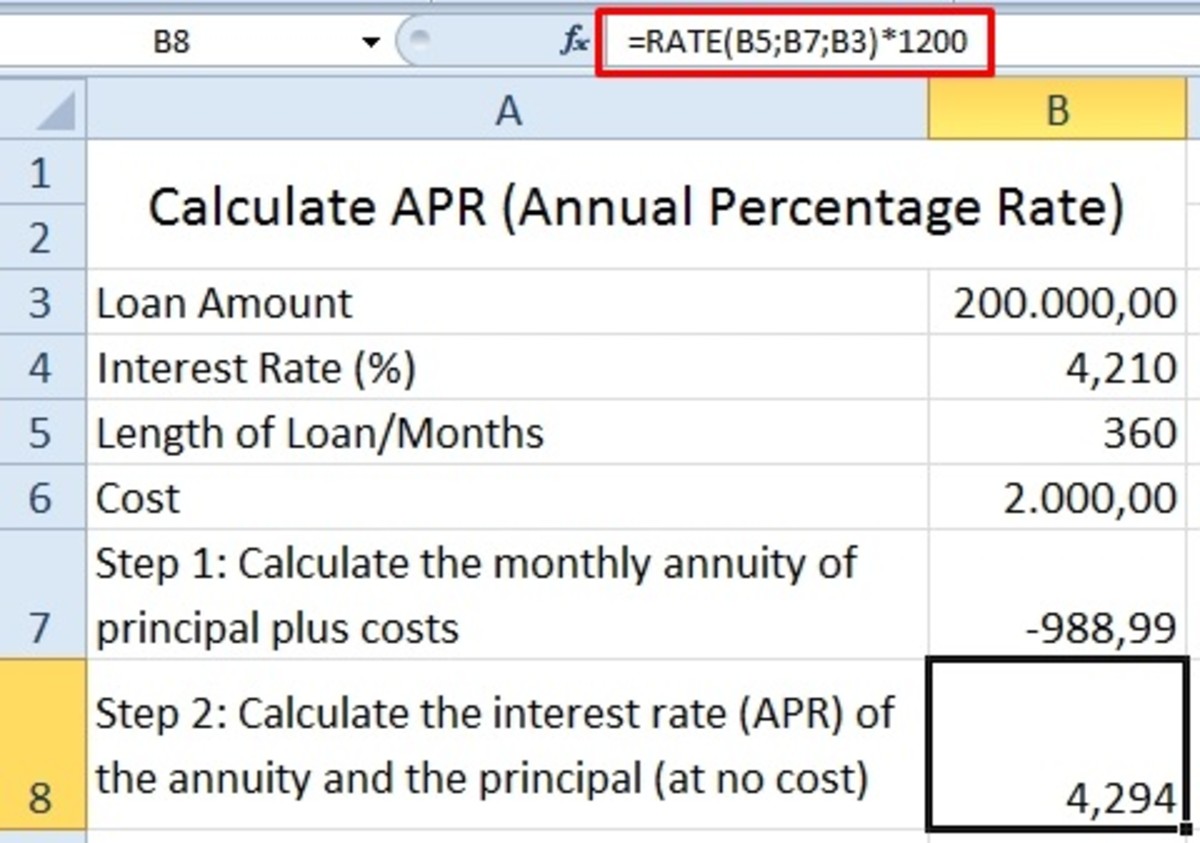

Calculating the Effective Interest Rate

To calculate the effective interest rate, you can employ the following formula:

Effective Interest Rate = (1 + Nominal Interest Rate/Number of Compounding Periods)^Number of Compounding Periods – 1

Image: haipernews.com

For example, if you have a nominal interest rate of 5% compounded monthly (12 compounding periods per year), the effective interest rate would be:

Effective Interest Rate = (1 + 0.05/12)^12 – 1 = 0.05127

This means that the true cost or return on your investment is slightly higher than the nominal rate due to the compounding effect.

Importance of the Effective Interest Rate

Now that you understand how to calculate the effective interest rate, it’s time to explore its significance:

Accurate Assessment of Returns and Costs: The effective interest rate provides a more precise representation of the true cost of borrowing or the return on your investments. It eliminates the potential for underestimating or overestimating the actual interest rate, resulting in more informed decision-making.

Comparison of Loans and Investments: When evaluating multiple loan or investment options, comparing their effective interest rates allows for a fair and comprehensive assessment. This ensures you’re selecting the most suitable option that aligns with your financial goals.

Planning and Forecasting: Understanding the effective interest rate is crucial for financial planning and forecasting. It assists in projecting future interest payments or investment returns, enabling you to plan accordingly and make informed choices.

Unveiling the Power of Compounding

Compounding, the driving force behind the effective interest rate, deserves further scrutiny:

Exponential Growth: Compounding leads to exponential growth in the value of investments. As interest accrues on previously accumulated interest, the overall value increases at an accelerated pace.

Double-Edged Sword: Compounding can work both ways. While it magnifies returns for investors, it also amplifies interest charges for borrowers. Therefore, considering the impact of compounding is paramount when making financial decisions.

Image: haipernews.com

How To Find The Effective Interest Rate

Conclusion

Unveiling the secrets of the effective interest rate is a key step towards financial literacy. By understanding how to calculate and interpret it, you gain a powerful tool for making informed investment and borrowing decisions. Remember, the effective interest rate considers the time value of money and the impact of compounding, providing a more accurate picture of the true cost or return on your financial endeavors. Embrace the knowledge you’ve gained to navigate the financial landscape confidently, maximizing your financial well-being.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)