Navigating the world of banking and money management can be daunting, especially for those new to the process. One common question that arises is where to sign a check for deposit. Whether you’re making a deposit at your local branch, an ATM, or through a mobile app, understanding the proper etiquette and procedures is crucial to avoid any potential delays or errors.

Image: www.macrumors.com

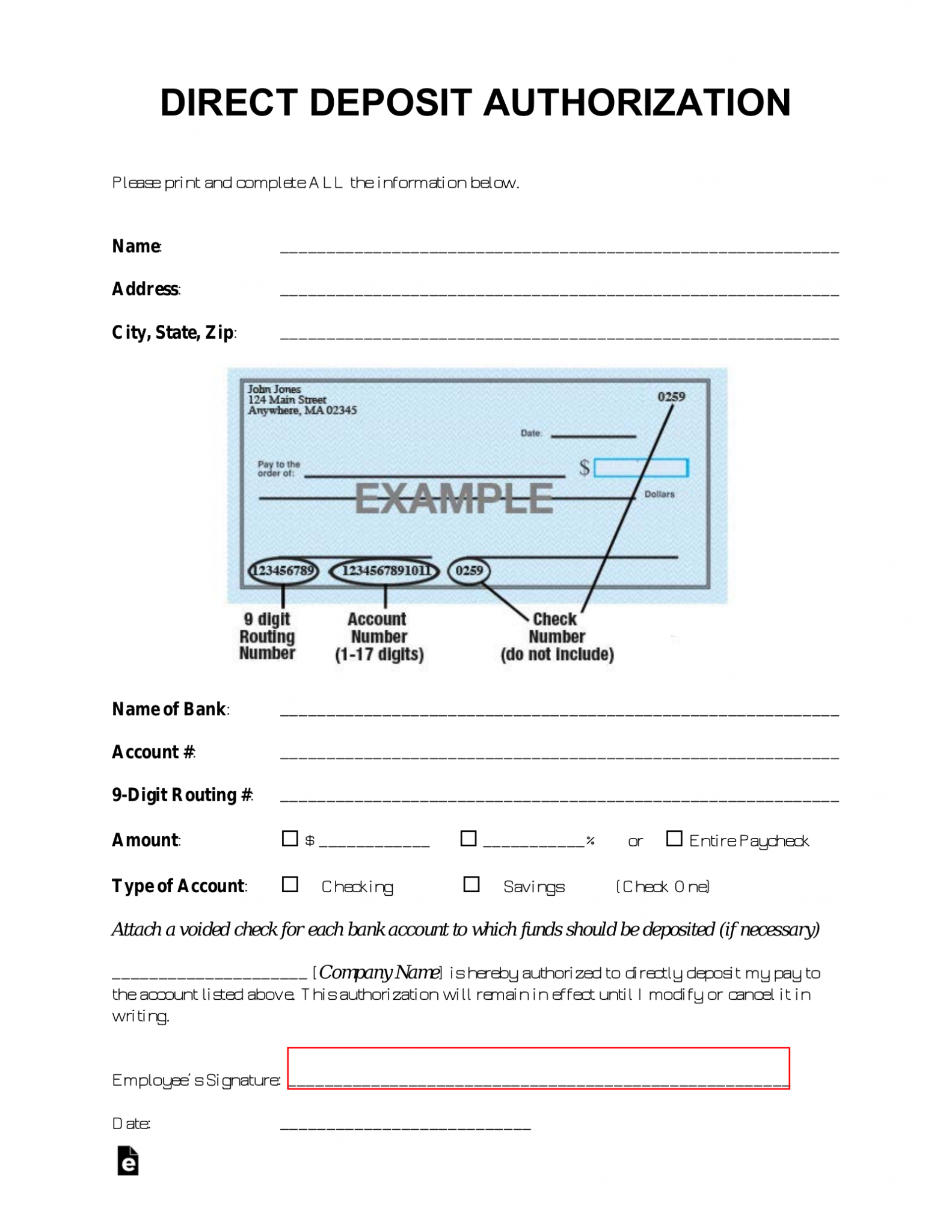

Identifying the Signature Line

The signature line on a check is usually located on the front of the document, towards the bottom right-hand corner. It’s typically a dotted or dashed line designated for your endorsement. When signing a check for deposit, be sure to sign within the designated area, leaving ample space above and below your signature.

Writing Your Signature

Your signature on a check serves as your authorization for the financial transaction. Therefore, it’s important to sign legibly and consistently. Use the same signature you would use on any other legal document, whether it be your usual cursive script or a printed signature. Avoid using initials or nicknames, as these may cause confusion or inconsistencies during processing.

Verifying Recipient Information

Before signing a check, carefully verify the recipient’s information on the check. Ensure that the payee (the person or organization you’re sending the money to) is correctly spelled and that their account information is accurate. If any errors are present, contact the issuer of the check immediately to rectify the situation.

Image: www.myxxgirl.com

Additional Tips for Check Deposits

- Always use a pen with dark, non-erasable ink.

- Sign the check as soon as possible after receiving it to prevent tampering.

- If depositing the check at a branch location, present valid identification.

- Keep a record of all check deposits, including the check number, date, recipient, and amount deposited.

- For mobile deposits, follow the specific instructions provided by your bank.

Expert Advice

For optimal efficiency, consider using the “For Deposit Only” line on the back of the check. This line prevents the check from being cashed or misused if it falls into the wrong hands. Additionally, if you frequently make deposits through the mobile app, ensure your phone’s camera is capturing clear and well-lit images of the front and back of the check.

Frequently Asked Questions (FAQs)

- Q: Can I sign a check with a different name than the payee?

A: No, it’s not advisable. Signing a check with a different name may cause delays or complications during processing. - Q: What should I do if I lose a check before signing it?

A: Immediately report the lost check to the issuer and your bank to prevent potential fraud. - Q: Can I deposit a check that has already been signed?

A: Yes, it’s possible but not recommended. Signed checks are typically intended for immediate processing or cashing. - Q: How long does it take for a check deposit to reflect in my account?

A: The time frame for check deposit clearance varies depending on your bank and the type of check. Generally, same-bank checks clear within one business day, while out-of-state checks may take up to several business days.

Where To Sign A Check For Deposit

Conclusion

Understanding where to sign a check for deposit is an essential aspect of check-based financial transactions. By following the proper guidelines outlined above, you can ensure the smooth and timely processing of your deposits. Always remember to sign within the designated area, verify the recipient information, and follow the specific instructions for different deposit methods.

Do you have any specific questions or need further clarification regarding check deposits? Let us know in the comments section below, and we’ll be happy to provide additional guidance.

:max_bytes(150000):strip_icc()/142202371-5ab3dbf1ff1b78003633a0dd.jpeg?w=740&resize=740,414&ssl=1)