Taxes, those inevitable financial obligations that accompany adulthood, can sometimes leave us longing for a simpler time. However, when it comes to filing your taxes accurately, having access to your previous year’s W-2 form is crucial. Whether you’ve misplaced it, experienced a life event such as a job change, or simply need a copy for your records, retrieving an older W-2 can seem like a daunting task. Fear not, for this comprehensive guide will lead you through the steps to reclaim your past earnings information with ease.

Image: apspayroll.com

Understanding W-2s and Their Importance

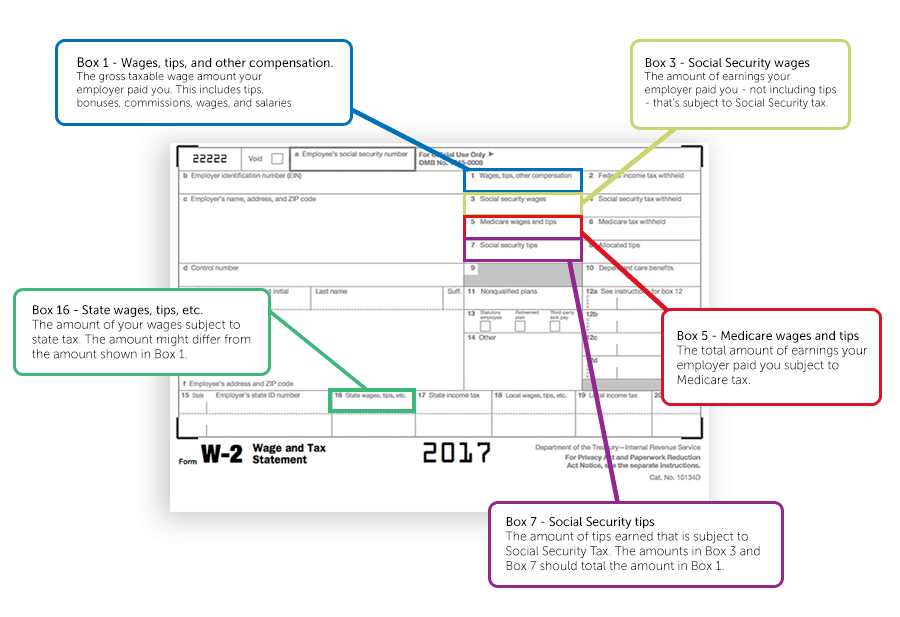

A W-2 form, also known as the Wage and Tax Statement, serves as an official record of your earnings and taxes withheld during a specific tax year. It is issued by your employer and is vital for completing your tax return. Without it, you may face delays in processing your tax refund or even penalties for incorrect reporting. Therefore, having a copy of your W-2 is essential for ensuring a smooth and accurate tax filing process.

Exploring Options for Retrieving Previous Year’s W-2s

Life’s unexpected turns can sometimes disrupt our organized systems, resulting in the loss of important documents like W-2 forms. However, there are several avenues you can explore to retrieve your missing or outdated W-2s:

-

Contact Your Former Employer: Your first step should be to reach out to your previous employer. Most employers maintain records of employee W-2s for several years. Explain your situation and request a copy of the W-2 you need. If they have it on file, they may be able to provide it to you electronically or via mail.

-

Utilize the Social Security Administration (SSA): The SSA maintains a record of your earnings history, including W-2 information. While they do not issue duplicate W-2s, you can request a free Earnings and Benefits Statement (Form SSA-7005) that includes your W-2 data. You can request this statement online, by phone, or in person at a local SSA office.

-

File Form 4506-T with the IRS: Form 4506-T allows you to request a copy of your tax return transcript from the Internal Revenue Service (IRS). This transcript includes the same information as your W-2, such as your earnings, taxes withheld, and deductions. It can take up to 7 to 10 business days to process your request and receive your transcript.

-

Use Online Paystub and Tax Document Services: Some payroll and tax document services allow you to access previous W-2s online. If you have used these services in the past, check if they have a record of your old W-2s.

Image: www.forbes.com

How Can I Get A Previous Year’S W2

Simplifying the Retrieval Process for Future Years

To avoid the hassle of retrieving past W-2s, consider adopting the following proactive measures:

-

Request an Electronic Copy: Many employers now offer the option to receive your W-2 electronically. This digital copy can be easily saved and stored in a secure location.

-

Keep Paper Copies: If you prefer a physical copy, make sure to keep it in a safe and organized place. Consider storing it in a fireproof safe or file cabinet.

-

Utilize Online Storage Services: Cloud-based storage services provide a convenient and secure way to store digital copies of your W-2s. This allows you to access your documents from anywhere, anytime.

By implementing these strategies, you can ensure that you have easy access to your past W-2s whenever you need them. Remember, accurate tax filing is crucial for protecting your financial well-being. So, take the time to retrieve any missing W-2s and keep your records up-to-date.

/GettyImages-1303637-two-way-mirror-57126b585f9b588cc2ed8a7b-5b8ef296c9e77c0050809a9a.jpg?w=740&resize=740,414&ssl=1)